|

|

Arthur Young CPAs Predict 22% Budget Windfall for Proposed City of Santa Clarita.

Letter from Arthur Young, September 18, 1987.

|

Webmaster's note: Part of the rationale for incorporating Santa Clarita as a city was that area taxpayers were paying L.A. County more in taxes ($3.5 million more annually) than they were getting back in the form of municipal services.

Arthur Young September 18, 1987

Santa Clarita Incorporation Committee Members of the Santa Clarita Incorporation Committee: Arthur Young was retained in January 1987, by the Santa Clarita Incorporation Committee to assess the proposed City’s budgets as prepared by the Los Angeles County Local Agency Formation Commission (LAFCO). Our primary objective was to evaluate the revenue and expenditure data compiled by LAFCO and to comment on the potential degree of reliability inherent in these data. The Incorporation Committee retained Arthur Young due to our audit and management consulting experience with the newly formed cities of Agoura Hills, Westlake Village, West Hollywood and Moorpark as well as our experience with larger and well established municipalities such as Beverly Hills, Lancaster and Palmdale. Based on Arthur Young's knowledge of municipal finance, the Committee believed our firm would be well-suited to assess the potential strength of the proposed City of Santa Clarita's finances. Currently, LAFCO's estimated budget for the proposed City of Santa Clarita (contained in a LAFCO report dated April 22, 1987) presents revenues of approximately $3.5 million over expenditures. This budget reflects a very positive financial outlook for the proposed City. In addition, several factors which have not been quantified in LAFCO's analysis may serve to enhance the City's already positive financial outlook. These factors include:

In conclusion, given Arthur Young's municipal finance and audit experience and LAFCO's revised budget estimates, it appears that a very healthy financial outlook exists for the proposed City of Santa Clarita with first year revenues exceeding expenditures by 22 percent. Very truly yours, ARTHUR YOUNG By: David C. DeRoos jm

LW3059: pdf of photostat of letter, collection of Connie Worden Roberts. Download pages here.

|

Santa Clarita at 30

FULL BOOK

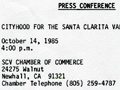

Press Kit 10-14-1985

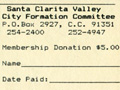

Membership Form ~1985

Cityhood Application 12/17/1985

Boundary Map 1/2/1986

Cityhood Petition #1, 1986

Pre-Cityhood Chamber Meeting ~1986

Formation Committee Logo 1987

First Public Forum 1/13/1987

Poll Results: Cityhood (Feb. 1987) The Case for Cityhood (Presentation to LAFCO, 2-25-1987)

Arthur Young Report 9-18-1987

Cityhood Campaign Office

Storyboard: TV Commercial 1987

Inauguration Program 12/15/1987

Audio Recording of First City Council Meeting 12/15/1987

Incorporation Night Slide Show 12/15/1987

Post-Election Voter Registration Drive 12-1-1987

Jo Anne Darcy | Legacy

Carl Boyer | Legacy

History of the Push for Self-Government, Connie Worden-Roberts, 1999

|

The site owner makes no assertions as to ownership of any original copyrights to digitized images. However, these images are intended for Personal or Research use only. Any other kind of use, including but not limited to commercial or scholarly publication in any medium or format, public exhibition, or use online or in a web site, may be subject to additional restrictions including but not limited to the copyrights held by parties other than the site owner. USERS ARE SOLELY RESPONSIBLE for determining the existence of such rights and for obtaining any permissions and/or paying associated fees necessary for the proposed use.